We invite you to take a look at how the top countries where it is best to buy real estate have changed. You may be genuinely surprised by this list, which has been compiled taking into account current trends, statistical data, and the policies pursued by these countries. We have tried to be as objective as possible so that your investments will bring stable returns. This list is compiled from the most interesting countries for investment to the least interesting.

UAE

Market overview. The real estate market in the United Arab Emirates continues to attract investors from around the world, remaining one of the most dynamic and affordable in the region. Dubai, with its developed infrastructure, combination of business and tourism potential, and active construction, remains a key center. According to the Khaleej Times, in February 2025, the volume of real estate transactions in the emirate reached an impressive 51.1 billion dirhams (approximately US$14 billion), which is 40% higher than the figures for the same period last year. Over the past five years, the market has grown by 449%, and in January, the growth rate was 27% year-on-year.

However, alongside these impressive figures, concerns are growing about the possibility of the market overheating. The Financial Times notes that property prices in Dubai have already exceeded pre-2008 crisis levels, and current growth rates are outpacing those of cities such as London, Paris, and Madrid. Experts point to signs similar to those of the previous market bubble: an increase in speculative transactions, a rise in the share of short-term investments, and sales aimed at quick profits. The premium segment of the market appears to be particularly vulnerable.

Rent. According to CBRE's report for the fourth quarter of 2024, rental rates for apartments in Dubai increased by 12% over the year, and for villas by 4%. The cost of renting a studio apartment ranges from 4,000 to 8,000 dirhams ($1,090–$2,180) per month, and a one-bedroom apartment from 6,000 to 12,000 dirhams ($1,635–$3,270). According to DAMAC Properties, the average return on rental properties is 6-8% per annum.

Conditions for foreigners. Foreign investors are allowed to purchase real estate in specially designated areas (freehold). In other areas, leases of up to 99 years (leasehold) are possible. Transactions are carried out through licensed agencies using escrow accounts. Legal regulation is carried out at the level of each emirate; in particular, inheritance issues are regulated by local legislation.

From February 2025, banks will no longer cover additional costs when purchasing real estate, including the Dubai Land Department fee (4%) and brokerage commission (2%). Thus, for a transaction worth 1 million dirhams ($272,000), the buyer must additionally contribute 60,000 dirhams ($16,336) of their own funds.

The conditions for obtaining investment visas have also been changed. When purchasing real estate under construction, at least 50% of the funds must be paid from the buyer's own funds. The use of mortgage programs when purchasing finished properties is no longer permitted. However, a long-term “golden visa” valid for 10 years is still available when purchasing a property worth 2 million dirhams ($545,000) or more.

Additional costs:

- The Dubai Land Department (DLD) charges 4% of the property value as a registration fee;

- The real estate agent's commission is usually around 2% of the sale price;

- Service charges vary depending on the area and type of property, starting at 10 dirhams ($2.70) per square meter.

Forecasts. According to a report by Knight Frank, real estate prices in Dubai are expected to grow by 5% in 2025. A CBRE study notes that the emirate's real estate market remains balanced. The outlook is assessed as moderately positive, but many investors have begun to sell assets, fearing a repeat of the crisis and a sharp decline in prices.

Portugal

Market overview. Despite a brief slowdown caused by the pandemic, the housing market in Portugal showed steady price growth. In the first ten months of 2024, real estate prices rose by 11% compared to the same period last year. Demand for housing was fueled by a significant influx of foreign investment, exceeding €2.5 billion, as well as net migration, which amounted to more than 155,000 people over the previous year.

By the beginning of 2025, the average price per square meter of housing in Portugal ranged from €2,000 to €2,500. In Lisbon, this figure was significantly higher, reaching €4,000 to €5,000 per square meter. In central areas of the capital, such as Chiado, prices reached €7,700 per square meter.

Although there are signs of a slowdown in the market, demand for residential real estate remains significant among both local and foreign buyers.

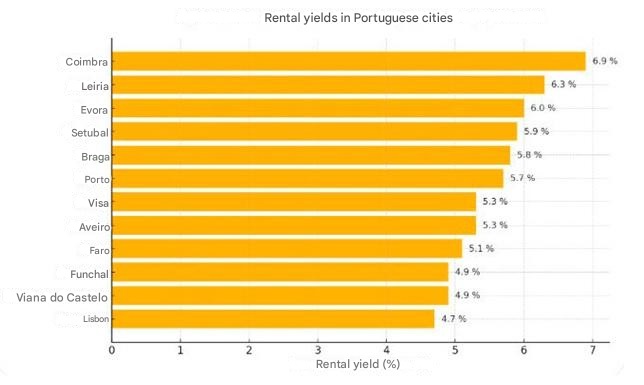

Rental. In the third quarter of 2024, the gross return on investment in rental property reached 7.2%. The most attractive rates of return were observed in Coimbra (6.9%) and Leiria (6.3%). Lisbon recorded the lowest yield at 4.7%.

The purchase of rental properties during this period yielded a gross profit of 7.2%. The cities of Coimbra and Leiria lead in terms of yield, with 6.9% and 6.3% respectively. Lisbon has the lowest yield, at 4.7%.

In Lisbon, despite restrictions imposed by the authorities on short-term rentals in central areas due to an excess of tourists, it is still possible to achieve high returns from renting out property. According to The Portugal News, short-term rentals during the season can yield 10–14% returns. In areas such as Estrela and Lapa, long-term rentals can achieve returns of 5–7%. These figures make investing in real estate in certain areas of Lisbon attractive, even with the current regulatory measures in place.

Foreigners and taxes. There are no restrictions on purchasing real estate in Portugal. The property transfer tax (IMT) varies from 0 to 8% of the property value; in Lisbon, this rate is around 6.5% (according to Global Citizen Solutions). The annual municipal tax (IMI) ranges from 0.3 to 0.45% of the assessed value. Income from renting out real estate for non-residents is taxed at a fixed rate of 28%.

Previously, new residents could take advantage of the special Non-Habitual Resident (NHR) tax regime, which provided tax benefits. However, since the beginning of 2024, the acceptance of new applications for participation in the NHR program has been suspended.

Forecasts. Analysts predict that real estate prices in Portugal are likely to continue rising until at least 2026 due to problems in the construction sector and high demand. At the same time, changes in legislation, such as the exclusion of real estate investments from the Golden Visa program, may affect the market's attractiveness. It is important to keep an eye on the latest developments, as short-term rental regulations are tightening in Europe.

Spain

Market overview. The Spanish real estate market in 2025 is characterized by steady, albeit moderate, price growth. According to Cadenaser, the price per square meter in Barcelona increased by 12.8% to €4,700, while in Madrid, housing prices rose by 20% to €4,952 per square meter. Valencia showed growth of 24% (to €2,836), and in Malaga, prices increased by 21.5%.

Residence permits and the Golden Visa. The Golden Visa program, which allowed investors to obtain a residence permit when purchasing real estate worth €500,000 or more, expired in April 2025. Despite the closure of the program, investors who managed to take advantage of it will retain their rights, but new applications will no longer be accepted.

Rental income. Rental yields in Spain vary between 5% and 6% per annum. In resort towns and student centers such as Valencia and Malaga, yields can reach 6% to 7%. In Madrid and Barcelona, this figure is slightly lower, at 4–5%, which is explained by the higher cost of real estate. Short-term rentals aimed at tourists can significantly increase returns during peak seasons. At the same time, the authorities are introducing restrictions on short-term rentals. Reuters reports that Barcelona has banned short-term rentals until 2028.

Taxes and risks. Owning real estate in Spain involves financial and legal risks. In addition to high taxes, there are concerns about illegal seizure of housing. When purchasing real estate, a property transfer tax (ITP) of 6–10% is payable for secondary housing, and VAT of 10% is payable for new buildings. The annual property tax (IBI) varies from 0.4% to 1.1% of the cadastral value, depending on the location. Rental income is also subject to taxation: 24% of gross rent for non-EU residents and 19% of net income for EU residents.

There is a risk of encountering squatters, illegal residents whose eviction can drag on for years, increasing potential losses for owners. Currently, there is discussion about introducing a 100% tax on real estate purchases by foreigners, as well as a complete ban on the purchase of housing by citizens of non-EU countries.

Forecasts. According to experts' forecasts, by 2025, prices for Spanish real estate will grow by 5%, then the growth rate will slow down to 3% in 2026 and to about 2% by 2027. The main factors driving growth are lower interest rates, moderate inflation, and a housing shortage, which, according to economist Miguel Cordoba, amounts to about one million properties on the sales market and half a million on the rental market.

Greece

Market overview. In 2025, the Greek real estate market is showing steady growth, but new regulatory measures may slow it down in the future. According to experts' forecasts, prices will continue to increase by 3-5% during the year, but in 2026, growth rates may decline.

According to Indomio, in February 2025, the average price per square meter of housing reached €2,543, which is 1.64% higher than in the same period in 2024. Rental rates also rose, increasing by 3.5% over the year and reaching €10.05 per square meter per month. Rental yields vary between 3.7% and 8.3%, averaging around 5%, with small apartments in popular tourist areas of Athens showing the highest yields.

Greece continues to attract foreign investors through the Golden Visa program, but the minimum investment threshold for obtaining a residence permit in the most sought-after locations (Athens, Thessaloniki, Mykonos, Santorini) has been raised to €800,000.

Forecasts. According to the Times, a moratorium on the registration of new short-term rental properties has been introduced in a number of central areas of Athens since the beginning of 2025. In addition, from October 2025, additional requirements for short-term rental properties will come into force, relating to the presence of windows, natural lighting, ventilation, and air conditioning. The government is also increasing the tax on short-term rentals, which will rise from €1.5 to €8 per day during the high season (April-October) and from €0.5 to €2 during the winter period, according to Reuters.

Georgia

Market overview. In 2025, the Georgian real estate market remains attractive to international investors, thanks to a stable economy and high demand. Tbilisi and Batumi remain the most sought-after destinations. According to RECOV, in February 2025, new buildings in Tbilisi rose in price by 20.4% compared to February 2024, and in Batumi by 14.4%.

Georgia offers foreign investors favorable legal conditions and tax incentives. The purchase of real estate, with the exception of agricultural land, is available to foreigners. The transaction process is simple and takes only one day, with ownership rights registered in an electronic registry. The tax burden is minimal: there is no purchase tax, the rental tax for individuals is 5% of gross income, and there is no capital gains tax. The sale of housing is not subject to VAT.

Investors can obtain a residence permit (RP) when purchasing real estate worth €300,000 or more. In addition, Georgia offers the possibility of staying for up to one year without a visa or registration.

Rental. According to Global Property Guide, rental yields in Tbilisi range from 8% to 10% in residential areas and drop to 5-6% in the center (Saburtalo, Vake). Galt & Taggart estimates rental yields at 9%. In Batumi, this figure can reach 10-12% per annum. The growth in tourist traffic (more than 7 million visits in 2024) supports demand for rentals.

Forecasts. The Georgian real estate market is expected to continue its steady growth in 2025. Of particular interest is the hotel sector, where the opening of new branded properties promises high returns. Experts predict further growth in demand for real estate in Georgia, driven by a stable economy and interest from foreign investors. A liberal economy and low taxes make the country attractive. The market is growing steadily, and asset liquidity is being maintained, especially in Tbilisi and on the Black Sea coast.

Thailand

Market overview. An analysis of the Thai real estate market shows price growth in all sectors in the fourth quarter of 2024, according to information from the Bank of Thailand. The highest prices for two-bedroom apartments in February 2025 were recorded in Bangkok and Phuket, at 296,134 and 296,134, respectively. Next are Pattaya (Chonburi) and Samut Prakan, where the average price is 106,845. In Nonthaburi, similar housing can be purchased for $89,230.

According to data from the Bank of Thailand, villas showed an increase of 2.55% in annual terms, and townhouses – 3.53%. Taking inflation into account, these figures are adjusted to 1.54% and 2.51%, respectively. A slowdown in growth is observed in the apartment segment.

In the first quarter of 2025, experts estimate the average gross rental yield in Thailand at 6.15%. In Bangkok, this figure is 6.05%, and in Phuket, it is 5.88%. The highest yield is recorded in Samut Prakan Province, at 7.07%.

It is important to take into account the rules for foreign buyers: there is a 49% quota on ownership of apartments in condominiums, and the purchase of land is not permitted. Long-term leases (30-year leaseholds with the possibility of renewal) also carry certain risks for foreigners.

Taxes and fees. When purchasing real estate, the following taxes and fees are levied:

- A registration fee of 2% of the appraised value of the property is usually divided equally between the buyer and the seller.

- Stamp duty is 0.5%, provided that the property is not subject to Special Business Tax (SBT);

- SBT of 3.3% applies if the seller has owned the property for less than 5 years;

- The annual property tax varies from 0.02% to 0.1% of the appraised value.

Non-residents receiving rental income are subject to a 15% tax if the lease is officially registered. Some investors avoid paying taxes by registering leases unofficially or receiving income through foreign accounts, which carries the risk of fines and arrests due to landlord inspections. The hotel industry is discussing a complete ban on short-term rentals.

Forecasts. Experts are cautious in their forecasts for the Thai real estate market. Moderate growth is expected, but global trade tensions could slow the country's development and negatively affect all sectors of the economy. The domestic market faces the risk of an increase in defaults and non-performing loans due to high private sector debt. An increase in tourist traffic is seen as a positive factor for real estate investment.

Indonesia

Market overview. The Indonesian real estate market continues to attract interest from foreign investors, especially in Bali, where prices for villas and apartments are rising by 8-10% in popular areas such as Changu and Uluwatu. According to BaliException, the average price of a villa with a pool in Bali ranges from up to €500,000, and apartments from up to €150,000. In Jakarta and other major cities, although the market is less active, prices are also rising thanks to the development of infrastructure and new business centers.

Rental. Indonesia attracts investors with high rental yields. It is expected that in 2025-2026, property owners in Bali will be able to earn 10-12% per annum from rentals, especially during peak tourist seasons. In Jakarta, according to Numbeo, this figure is 6-8% depending on the location and type of property.

In Indonesia, foreigners can purchase real estate through the Hak Pakai (right of use) system for up to 30 years with the possibility of renewal, but they do not have the right to direct ownership of land (Hak Milik). Long-term leases of land or private homes are possible through local partners or by setting up a foreign-invested company (PT PMA), which carries certain risks.

The Indonesian authorities are tightening their policy towards foreigners by conducting strict checks. As a result, a major developer in Bali was arrested and the PARQ Ubud apartment complex was closed. Previously, restrictions were imposed on the construction of certain tourist facilities and the rules for foreigners' stay were tightened. The possibility of introducing a tax of $100 per day for tourists is being considered.

Forecasts. Despite stricter regulations, Indonesia remains attractive to investors thanks to high tourist demand and a growing economy. Infrastructure development and improvements to the transport network are making the real estate market even more attractive. According to Global Property Guide forecasts, moderate price growth of 5-7% is expected in 2025.

Cyprus

The Cyprus real estate market overview for the fourth quarter of 2024 shows mixed dynamics. According to the Ask Wire index, apartment prices rose in both the sales (by 1.3%) and rental (by 1.5%) segments. Holiday apartments also showed growth (0.9%). At the same time, residential houses became cheaper (by 0.3%), rental payments for them decreased (-0.8%), and holiday villas lost 0.6% in value. Warehouse and retail space also showed negative dynamics.

According to the Department of Land and Surveys, total housing sales for the year increased by 1%, with growth in Nicosia (14%) and Larnaca (5%), but declines in Paphos (-8%), Famagusta (-5%), and Limassol (-1%). Sales to EU citizens fell by 3%, particularly in Limassol (-13%) and Paphos (-8%). Transactions with third-country nationals fell by 12% year-on-year.

Rental. Average rental rates in Cyprus are €1,803 for apartments and €3,249 for houses, with Limassol leading the way (€2,742 and €4,492, respectively). Rental yields range from 6.74% to 7.17% on average across the country, with the highest in Paphos (7.5%).

With immigration policies tightening and sanctions compliance checks increasing, foreign investment is at risk. Cypriot banks are closing Russian accounts. The authorities are considering banning short-term rentals and abolishing VAT exemptions for foreigners.

Forecasts for 2025-2026 link the stimulation of the real estate market with a decrease in interest rates, while maintaining demand for apartments. However, a possible ban on short-term rentals, proposed by the Council for the Registration of Real Estate Agents, could negatively affect investment attractiveness.

Turkey

Market overview. An overview of the Turkish real estate market in 2025 shows an upward trend due to high domestic demand. Istanbul is the most popular, followed by Ankara, Izmir, and the Mediterranean resort areas, particularly Antalya and Alanya. In Istanbul, housing prices range from $800 to $1,000 per square meter on the outskirts and from $3,000 to $5,000 in prestigious areas. According to the Central Bank, in January 2025, nominal price growth was 31.9% compared to January 2024, but in real terms, there was a 7.2% decline.

According to analysts, the decline in the share of foreign investors is due to stricter legislation. In January, there was a 24.9% decrease compared to the same period last year, down to 1,547 transactions. Foreign buyers accounted for only 1.4% of the total, according to data from the Turkish Statistical Institute.

Rental. The average gross rental yield for the country, according to Global Property Guide, is approximately 7.41%. In the residential areas of Istanbul, this figure reaches 6-8%, while in the central areas it drops to 2-4%. In Antalya, the average yield is 5.73%, with some properties yielding up to 9% or more.

There are a number of restrictions for foreigners. Many areas are closed to real estate purchases. Financial requirements for obtaining a residence permit (up to $200,000) and citizenship ($600,000) have been significantly increased. The requirements for obtaining a Turkish passport have been tightened: only one person can be the owner, and it is not possible to purchase real estate from non-residents if you plan to obtain citizenship.

Taxes. When completing a transaction, it is necessary to obtain a tax identification number. The transaction is certified at the Land Registry Office (Tapu) with the participation of an interpreter.

- The purchase tax is 4% of the appraised value (usually divided between the buyer and the seller).

- The annual property tax varies from 0.1% to 0.3% of the value, depending on the city.

- Rental income is subject to progressive income tax (15-40%) with the possibility of standard deductions.

When purchasing real estate with funds transferred from abroad, you can obtain a VAT exemption (18%) if the property is purchased for investment purposes and the buyer is not a resident of Turkey.

Forecasts. There are risks associated with economic volatility, inflation, and political instability. The arrest of Istanbul Mayor Ekrem Imamoglu, who is running for president, has negatively affected foreign investor confidence. However, experts believe that once the situation stabilizes, the Turkish real estate market will remain attractive.

Latvia

An overview of the Latvian real estate market presents a mixed picture for investors. Although Latvia is not always considered a priority destination for investment, Riga stands out in Europe, demonstrating returns of up to 8.47%, which is why it made it into the top 10. Riga, often referred to as the “Pearl of the Baltic,” attracts attention with its Art Nouveau architecture and historic Old Town. An example is a two-bedroom apartment in the Agenskalns district, purchased for €175,000, which can yield around 11.68% per annum when rented out for €1,700 per month.

However, Numbeo data indicates that the average rental yield in Riga is in the range of 3.43-4.13%, and in Latvia as a whole — 4-5%. In this regard, experts advise to carefully approach the selection of real estate properties.

As for prices, a square meter of housing in Riga costs between €1,500 and €2,000, while in other large cities this figure varies from €1,000 to €1,500. Jurmala and Liepaja offer housing that is 20–30% cheaper than in the capital. In Daugavpils, which is experiencing population decline, prices can drop to €300–400 per square meter. Rental rates in Riga are showing growth of 3–4%, reaching €12–15 per square meter per month. In resorts such as Jurmala, rates can rise to €20–25.

Latvia levies a property transfer tax of 2% of the purchase price, as well as an annual property tax of 0.2% to 1.5%. Rental income tax is 20%, with the possibility of deducting certain expenses.

Forecasts. In 2024, the Latvian real estate market showed signs of stagnation, but the decline in Euribor rates to 2% contributed to some revival. LSM experts note that activity may increase in the segment of new economy-class projects costing up to €2,500 per square meter. Uldis Rutkaste from the Bank of Latvia believes that the real estate market will show positive trends, but geopolitical risks remain.

We hope you found this information useful. If you would like to purchase real estate in one of these countries or in another country, please contact our manager in any way convenient for you.