Residential property prices in Montenegro continue to rise despite stabilising demand, reduced residential construction activity and the recent introduction of a progressive property tax.

In the year to Q2 2024, the national average price of new housing rose by 21.4% to €1,821 per square metre (sqm), following increases of 30.95% in Q1 2024, 27.95% in Q4 2023, 24.56% in Q3 2023, 9.09% in Q2 2023 and 6.01% in Q1 2023, according to Statistics Montenegro.

Adjusted for inflation, new housing prices in the second quarter of 2024 increased by 16.6 per cent year-on-year.

On a quarterly basis, the average house price rose by a modest 3.7 per cent (3.4 per cent inflation-adjusted) in Q2 2024, in contrast to a 1.9 per cent quarter-on-quarter decline in the previous quarter.

Housing Market Remains Active And Is Going To Stabilize

According to the Financial Stability Report 2023 of the Central Bank of Montenegro: ‘The majority of real estate agencies (82.1%) estimated that the average price per square metre has increased between 5% and 50%. The prevailing opinion among agencies is that prices will not change in the near future. They also believe that demand will not decrease, but will remain the same or even increase.’

‘During the year, demand was centred on flats priced between €1,580 and €2,360/m2. Flats in the broad centre of the capital as well as in cities in the southern part of the country were the most sought-after,’ the central bank's report added.

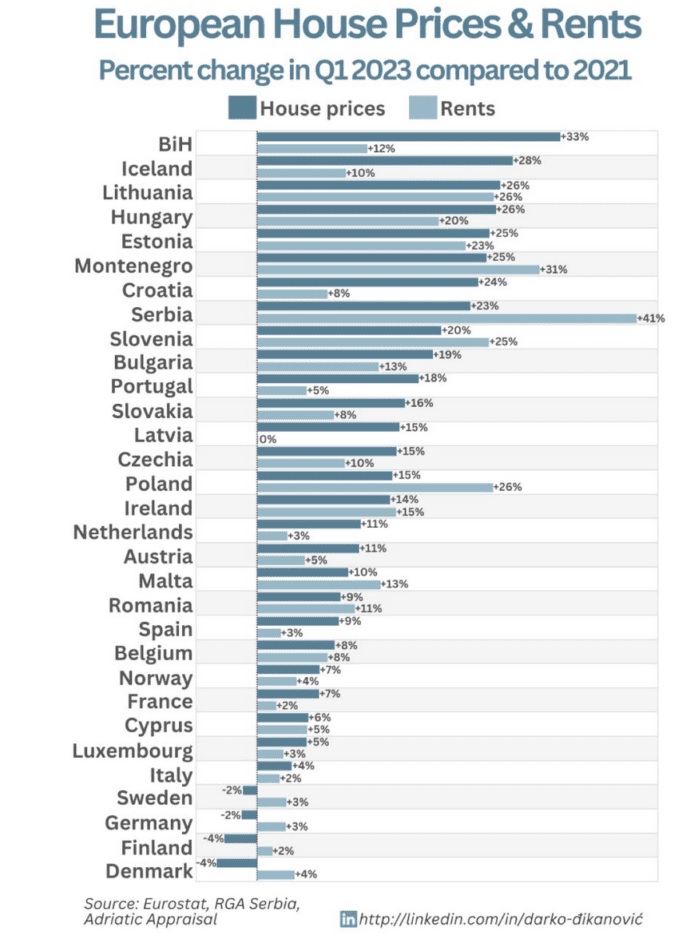

Annual Property Change Prices in Montenegro

In 2023, foreign investment in Montenegro's property sector totalled around EUR 463 million, up 3% from the previous year. However, FDI growth in the country's property sector has slowed this year amid the recent introduction of a progressive property tax. In the first eight months of 2024, foreign investment in real estate fell by 4.01% to EUR 284.92 million compared to the same period last year, according to the September 2024 bulletin of the Central Bank of Montenegro.

As of 1 January 2024, Montenegro has introduced a progressive property taxation system, which has a significant impact on the property market, especially in the premium segment. The new tax structure provides for a 3% tax on properties worth up to €150,000, combined flat and percentage taxes for properties worth between €150,000 and €500,000 and flat tax plus percentage for luxury properties worth over €500,000, according to information from an article published by LAM-Estate.

The move is aimed at increasing revenues from high-value property transactions and potentially stabilising the market by slowing speculative investment in luxury properties, according to the LAM-Estate article.

Despite the recent drop in activity, values are still above pre-pandemic levels, indicating continued foreign investor interest in Montenegro.

Residential property construction is also declining rapidly. In the second quarter of 2024, the number of residential building permits fell by almost 75 per cent year-on-year to 148, after annual increases of 2.8 per cent in 2023 and 232.2 per cent in 2022, according to the Statistical Office of Montenegro. Similarly, the total floor area decreased by 70.6% to 11,087 square metres in the second quarter of 2024 compared to last year's figure.

In 2023, the country posted another strong economic growth of 6 per cent year-on-year, following annual growth of 13 per cent in 2021 and 6.4 per cent in 2022, on the back of continued recovery in the tourism industry. The number of tourists visiting the country last year increased by nearly 20 per cent year-on-year to 2,613,306.

However, the International Monetary Fund (IMF) expects Montenegro's economic growth to fall to 3.7 per cent this year. On the other hand, the World Bank and the European Commission are even more conservative, forecasting Montenegro's real GDP growth at 3.4 per cent this year.

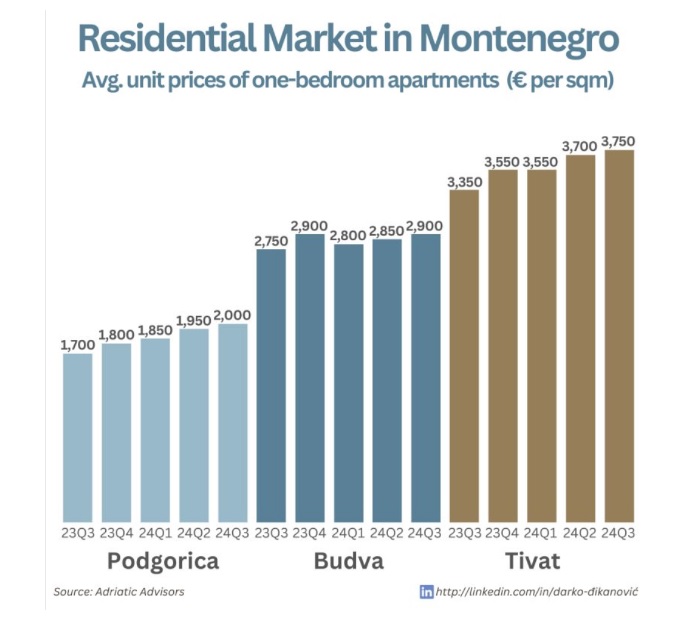

Local Variations in House Prices

Residential property prices in Montenegro vary considerably depending on location.

The cost of housing in Podgorica increased by 11.5% to 1,763 euros per square metre in the second quarter of 2024, according to the Statistical Office of Montenegro. This was the ninth consecutive quarter with double-digit price increases compared to the previous year. The most expensive apartments are in Podgorica I and Podgorica II, comprising the districts of Preko Morace, Block 6 and Gorica.

In the coastal region, one of the most expensive in the country, the cost of housing in the second quarter of 2024 averaged €2,107 per square metre, 49.1% more than last year and the highest in recent history.

In the central region, average housing costs increased by 34.5 % year-on-year to €960 per square metre in the second quarter of 2024.

In the northern region, housing costs were more or less stable compared to last year and stood at €1,200 per square metre in the first quarter of 2024.

Demand for Property in Montenegro

The attractiveness of Montenegro beckons foreign buyers. The property market on the country's coast depends to some extent on the state of the Russian economy, i.e. oil prices.

Budva is a charming coastal resort and Venetian port city with sandy beaches and a variety of entertainment, as well as a tourist centre that receives more than half a million visitors a year. In the Budva area is located the most expensive housing in Montenegro, prices for which now range from 1500 to 3000 euros per square metre.

The beautiful village of Sveti Stefan, adjacent to Budva, was a popular resort in the 1960s and 1980s.

The main foreign buyers of property in Montenegro are Russians, Serbs and Britons.

Following the lifting of pandemic-related restrictions, demand for Montenegro's coastal property has resumed. In 2022, the number of tourists increased significantly, by 30.7 per cent year-on-year to 2,183,975, after a sharp increase of 276.3 per cent in 2021. Tourism barely grew during the Covid-19 pandemic, with tourist arrivals falling by 83.2 per cent in 2020.

In 2023, tourist arrivals increased by 19.7 per cent year-on-year to 2,613,306 - on par with the pre-pandemic period in 2019. Similarly, the number of overnight stays reached 16.34 million last year, up 31.5 per cent from the previous year.

This year has seen a slight improvement in the situation in the tourism industry. In the first nine months of 2024, the number of tourists visiting Montenegro increased by 0.3 per cent to 1,226,499. The number of foreign tourists, who account for about 90 per cent of all visits, also increased by 0.9 per cent to 1,102,982.

In September 2024, foreign visitors were dominated by tourists from Serbia (17.2%), followed by the United Kingdom (9.5%), France (7.3%), Germany (7.2%), Poland (6.6%) and Bosnia and Herzegovina (3.9%).

More than 78.4% of tourists preferred to stay in seaside resorts, while 13% chose the capital city. In September 2024, the most popular resorts were Budva, Herceg Novi and Bar.

Foreign citizens are able to purchase property in Montenegro without any restrictions, with the exception of land plots, which must be purchased through companies. Once the building is completed, the ownership can be transferred to individuals under a simplified procedure.

In 2015, a decision was adopted according to which foreign property buyers receive a residence permit in Montenegro regardless of the value of the purchased property.

Serbs Are the Largest Foreign Home Buyers in Montenegro

In 2023, foreign investment in Montenegrin property totalled around EUR 463 million, up 3% on the previous year.

Serbs became the largest property investors, spending a total of EUR 78 million last year, surpassing Russians after Montenegro imposed sanctions against Russia.

Russians continue to be the second largest property investors, having spent about 56 million euros in 2023 to buy properties in Montenegro. Their share is approximately 29% of the total volume of foreign investment in the country's property last year.

Investors from Germany and Turkey are also actively investing in Montenegrin property: their total investments amount to 51 million euros. American investors invested 34 million euros, Ukrainian investors - 15 million euros, Swiss investors - 13 million euros, and investors from the UAE - 13 million euros.

Montenegro Property Market Offers

Decrease in Housing Construction Activity

In 2023, the number of residential building permits increased by 2.8 % to 2,217 units compared to the previous year. However, after a sharp increase of 232.2 % in 2022 and annual decreases of 50 %, 17.9 %, 32.4 % and 47.3 % in 2021, 2020, 2019 and 2018, respectively, data from the Statistical Office of Montenegro show a gradual slowdown in housing construction activity.

The total area of permits issued also increased by 8.6% to 143,370 square metres in 2023. However, in the second quarter of 2024, the number of housing construction permits decreased by 75 % to 148, and the area of residential premises decreased by 70.6 % to 11,087 square metres.

The following changes occurred in the second quarter of 2024:

- One bedroom dwellings: the number of permissions decreased by 13% to 20 and the total floor area decreased by 30.3% to 2,910m².

- Two bedroom dwellings: the number and total floor area of permissions decreased by 66.7% to 6 and 77.9% to 569m² respectively.

- Three-bedroom and larger dwellings: the number of permissions fell sharply by 77.2% to 120 and the floor area decreased by 75.9% to 7,244 m².

- Annexes (extensions): the number of authorisations fell by 85.7% to 2 and the floor area decreased by 56.2% to 364 m².

Residential Complexes in Podgorica

Several residential complexes have appeared in Podgorica in recent years. One of them is the urban quarter next to the Delta City shopping centre. It is the largest mixed-use complex in the city, consisting of twenty buildings with almost 1250 housing units.

Also worth mentioning are the New Urban Quarter (12 new residential buildings), Ljubović (about 170 flats), two new residential complexes in the Old Airport area, a mixed-use complex in Block X (142 residential buildings) and a residential building with 420 flats in Block VII.

Seaside Property is Showing Growth!

Foreign investors are attracted by the Montenegrin coast, especially the cities of Kotor, Tivat, Budva, Herceg Novi and Bar, which have been actively developing in recent years. According to the Statistical Office, in the second quarter of 2024, the average cost of residential property will be 2107 euros per square metre, which is 49.1% more than last year. In popular holiday resorts, prices could be even higher.

In the Budva Riviera, flats are selling for between €1,700 and €3,500 per square metre, luxury flats for between €3,500 and €6,000, and houses, cottages and villas for between €3,000 and €10,000 per square metre.

In Bar Riviera, prices for flats and luxury flats range from €1,400 to €3,000 per square metre and for houses, cottages and villas from €1,200 to €3,500 per square metre.

Rental Property Market in Montenegro

The rental market is developing and yields remain at moderate levels. Rental prices continue to rise due to high demand. Currently, one-bedroom flats in Montenegro rent for between €450 and €1,000 per month and two-bedroom flats for between €700 and €1,100.

- In Podgorica and other coastal towns, especially Budva, rents can be higher:

- In Podgorica, the average rent is 570 euros per month.

- In the Bay of Kotor, the average rent is 880 euros per month.

- In Tivat, rents are even higher - around €1,025 per month.

- In Budva, residential properties are rented for an average of 1370 euros per month.

Gross rental yields in Montenegro are moderately high, averaging 5.61 per cent in the third quarter of 2024, down slightly from 5.95 per cent in the same period last year, according to a recent study by Global Property Guide.

By main regions:

- In Podgorica, rental yields for flats range from 5.81% to 7.62%, with the city average of 6.67% in Q3 2024.

- In Tivat, rental yields range from 4.71% to 5.45%, with an average of 5.08%.

- In Budva, rental yields range from 4.3% to 5.49%, with an average of 5.08%.

Mortgage for Foreigners in Montenegro

Obtaining a mortgage loan for foreigners in Montenegro is difficult, but not impossible. Non-residents can expect to receive a mortgage in several banks with a maximum loan-to-value ratio (LTV) of 50% and a term of up to 25 years, according to information from Dream Estates Montenegro.

However, mortgage lending does not apply to all types of property, but only to new properties from major developers. Exceptions are possible if the property is located in a development complex accredited by the bank.

Among the banks providing mortgage loans to foreigners are Erste Bank, Hypo Alpe Adria, Societe Generale, Lovćen Bank, First Bank, NLB Banka and Crnogorska Komercijalna Banka.

|

HOUSING LOANS FOR FOREIGNERS |

||||

|

Erste Bank |

Lovćen Bank |

First Bank |

Crnogorska Komercijalna |

|

|

Loan amount |

€10,000 - €400,000 |

€10,000 - €200,000 |

€5,000 - €100,000 |

€50,000 - €300,000 |

|

Payment period |

Up to 20 years |

Up to 10 years |

Up to 25 years |

Up to 25 years |

|

Nominal interest rate |

From 3.99%+6M Euribor |

From 4.95% |

7.99% to 11.49% |

5.5% to 7% |

|

Loan processing fees |

Up to 1% |

Up to 1.25% |

1.5% to 2% |

Up to 1% |

|

Payment method |

Monthly |

Monthly |

Monthly |

Monthly |

|

Source: Savills Dream Estates Montenegro |

||||

According to the Central Bank of Montenegro, in September 2024, the average interest rate on new housing loans obtained from banks was 5.08%. This indicator has decreased compared to 5.79% in the previous year, but still exceeds the values of 4.61% recorded two years ago.

As for housing loans, their average interest rate in September 2024 was 5.07 %. This value is slightly higher than the values of the previous year (4.98 %) and two years ago (4.58 %). During the same period:

Up to one year: 5.11 %, which is higher than the values of September 2023 (6.18 %) and September 2022 (6.43 %).

More than one year: 5.07 %, which is also higher than the previous values (4.98 % and 4.58 %).

All this shows that now it is possible to buy property in Montenegro very favourably. Leave a request to our manager to make a free selection of apartments or houses in Montenegro for you, taking into account your needs and financial possibilities.