Madeira is a paradisiacal place in Portugal. Many investors want to buy apartments in Madeira and rent it out, because there are always enough tourists here. The property can be profitably rented out and get passive income. You can also buy a villa in Madeira to move or for investment purposes. However, before talking about all the charms of owning property here, it is worth considering why buying property in Madeira in Portugal is really profitable.

Analysis of the Madeira Property Market as an Investment Destination

Madeira's economy has a dynamic growth, with agriculture and tourism being the catalysts. Over the past few years, foreign investors' interest in property here has grown significantly. This is due to tax incentives and simplified property registration procedures for non-residents. Due to the growing demand, property prices in Madeira have started to increase rapidly, there are no sharp fluctuations, which gives investors full transparency and predictability of capital investment. In 2023, the price increase is 3%: not much, but it shows a steady increase in investment interest. The rental market also shows a +5% return for 2023.

Investors are attracted by the following:

- large number of economy and premium class offers on the market;

- high level of security;

- developed infrastructure;

- stable growth of property prices;

- a large number of festivals and other events that attract tourists;

- transparency of the transaction;

- the opportunity to take advantage of the Golden Visa programme in Portugal.

Buying property in Madeira is not just the purchase of housing or business, but also an investment in a developing and stable economy with high profit potential and capital growth. Titling and transactions in Madeira are carried out within a transparent and strictly regulated legal system, which ensures the reliability and integrity of transactions.

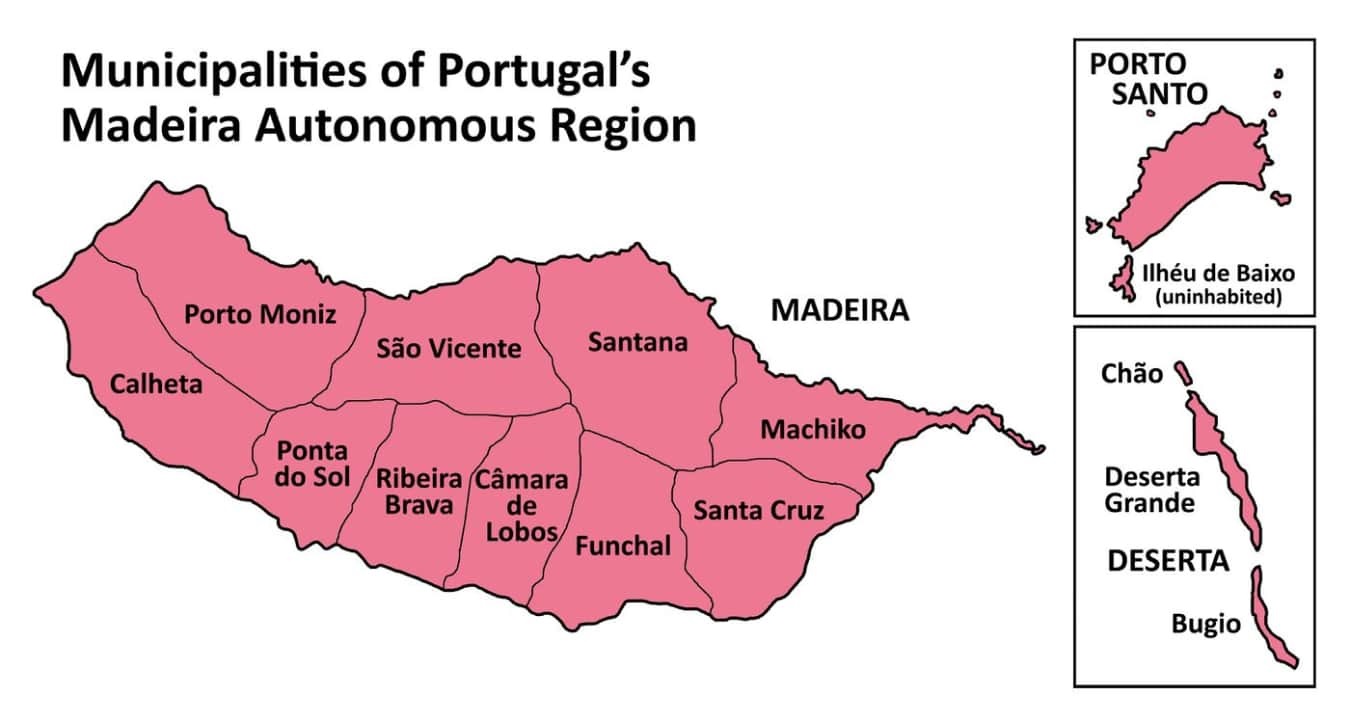

Where to Buy Property in Madeira

Although there are many regions in Madeira, only some of them are favoured by foreign investors. Research this information before buying a property so that it will really bring you passive income.

Monte

This area is located near Funchal. There is a large number of villas and houses of premium segment. Here you can buy a villa for yourself or to move to Madeira, if you want quietness, but are not ready to put up with the lack of infrastructure. This area has everything you need for a comfortable life. And the premium segment usually shows higher year-on-year price growth.

Canico

This area is located in the south-east of Madeira and has some of the best beaches on the island. You can buy flats and houses in Canico and rent them out profitably. There are also offers of apartments in hotels with a guarantee of occupancy

Caleta

This is a relatively young neighbourhood with a large number of new buildings. Due to this, you can buy property in Madeira at favourable prices. The infrastructure is modern and is actively developing. The area has great potential for growth, so now is a great time to buy property here.

Porto Manizh

Located in the north-west of the island, this area offers premium accommodation. There is also plenty of space for tourist infrastructure, so those looking to start a business in Portugal can buy a plot of land to build a commercial property.

Housing in Madeira

You can find enough housing options at the construction stage and on the secondary market in Madeira. The market is actively developing, objects are not on sale for a long time. Here is what you can buy:

- apartments;

- houses;

- villas;

- townhouses.

Investing in residential property is attractive because of the potential for profit from the rental business and the possibility of the property appreciating in value after a few years. Housing in Madeira has always been liquid, so you will be able to resell the asset if necessary and recover your investment.

Commercial Properties in Madeira

Practice shows that many investors want to start a business in Portugal. At the same time, they choose Madeira as a base, as it is a tourist island, where it is really profitable to work. Most often foreigners are interested in:

- office buildings;

- retail space;

- warehouses;

- hotels;

- restaurants.

Note. It is not only possible to run a business in Madeira on your own. Some people buy commercial properties to rent them out for passive income.

Plots of Land in Madeira

Buying of a plot of land in Madeira offers unique prospects for construction or agricultural activity, depending on the type of land. Building land is suitable for the construction of residential complexes, commercial buildings or mansions, allowing investors to realise their ideas. Agricultural land is suitable for farming or agro-tourism development, offering the opportunity to combine business with environmental care and sustainable practices.

Note. Before buying, be sure to look at the purpose of the land plot and whether it is connected to engineering communications. If the latter are absent, you will have to pull them at your own expense.

How to Buy Property in Madeira - Step-By-Step Instructions

Beginning investors are often lost and do not understand where to start, so we post step-by-step instructions on how to buy residential or commercial property on the island, taking into account the requirements of the legislation of Portugal.

- Selecting an object. You can view the options on our website, but we do not have time to load them all, so we recommend leaving a request for a manager to contact you and provide a free personalised selection taking into account your budget and requirements to the object.

- Checking the selected property. It is important to scrutinise its legal status and condition. This process consists of several key steps. Firstly, you need to make sure that the seller is the actual owner of the property and has all the documents to prove their right to sell. Then, it is necessary to establish whether the property is free from any liens, seizures or other legal obligations that may affect the transaction.

- Signing of the preliminary agreement or Contrato de Promessa de Compra e Venda. It specifies the terms of the deal, the price, the down payment, the method and currency of settlement and so on. Typically, the down payment varies from 10% to 30%. This agreement is a guarantee that the parties will carry out the transaction. If one of them refuses to sign the final contract, it will be obliged to pay a penalty to the other party.

- Notarisation of the contract or Escritura Pública. Once the conditions of the preliminary agreement have been fulfilled and the financing has been confirmed, the transaction will be finalised at the notary's office. The final stage is the signing of the final sale and purchase agreement (Escritura Pública de Compra e Venda) at the notary's office. The notary will check the legality of the documents and ensure that they comply with all legal regulations. After signing the documents, the buyer must pay the IMT and IMI taxes.

- Titling of the property. After that the object will belong to you legally.

Note. To buy property in Portugal, a foreigner must have a valid passport and a tax number issued in Portugal. The latter is required in order to be able to make financial transactions and register the transaction.

Are there any restrictions on benefits for foreigners when buying property in Madeira?

Foreigners have the same rights as Portuguese citizens when buying property in Madeira due to Portugal's favourable legislation. However, there are certain nuances to consider when planning an investment in residential or commercial property on the island.

Why do I need a tax identification number (NIF)?

In order to carry out financial transactions in Portugal, including Madeira, a Tax Identification Number (NIF) is required. This number is needed to record all property transactions, bank accounts and tax payments by foreign nationals. Obtaining a NIF can be started through the local tax authorities or through a trusted person and is the first step in the property purchase process.

Are special permits required to purchase property?

In some cases, especially when buying property in strategic, protected or historical areas of Madeira, a special authorisation may be required. This is due to national or local policies for the preservation of cultural heritage, environmental safety or the strategic importance of certain areas. Such authorisations are issued by the relevant regulatory authorities and require additional scrutiny of the proposed transaction.

How do I complete and register property documents in Madeira?

The process of buying property in Madeira for foreigners involves several important steps. Firstly, a preliminary contract (Contrato de Promessa de Compra e Venda) is concluded, which creates the legal basis for the transfer of ownership after fulfilment of all the conditions of the transaction. Then the purchase and sale agreement (Escritura Pública de Compra e Venda) is finalised before a notary. The title must then be registered with the regional property registry to officially confirm the rights of the new owner.

Can I buy a property in Madeira with a mortgage?

Theoretically it is possible, there are no legal restrictions. But, as practice shows, in the last few years, Portuguese banks have been refusing foreigners in obtaining a mortgage. This is due to the growing problem loan portfolio. Due to the increase in the key rate, many borrowers who took out floating rate mortgages have found themselves in a difficult situation and are unable to make timely payments. Thus, in order to protect themselves, banks have started to refuse non-residents a loan to buy property in Portugal.

Investment Prospects of Buying Apartments in Madeira

If a foreign investor does not plan to move to the island, he buys property in order to generate income. In this regard, he must have information about how much he will be able to get, whether it will be possible to sell the asset if necessary and what are the nuances that need to be aware of.

Due to the high demand for housing, flats and houses in Madeira are easy to rent out. Short-term rentals can generate an income of 5% to 10% of the value of the property. If you rent the property on a long-term basis, the return will be in the range of 6% per annum.

If you buy a flat or house in Madeira at the construction stage, you can get interest-free instalments until the end of construction, and the price will be below market by 10%-20%. The main risk of buying on the primary market - is the postponement of the completion of construction, as a result of which the projected prices at the completion of the object may change. An asset in the secondary property market at resale gives a return of 5% to 15%. It all depends on the location, age and condition of the object.

Taxes During the Purchase of a Property in Madeira

IMT (Imposto Municipal sobre as Transmissões Onerosas de Imóveis) is the main tax. It is payable at the time of titling and the amount depends on the type of property, the value and the status of the buyer.

Tax on Residential Property in Madeira On the Primary Market

|

Price (euro) |

Tax (%) |

|

Before 92,407 |

0 |

|

From 92,408 to 126,403 |

2 |

|

From 126,404 to 127, 348 |

5 |

|

From 172,349 to 287,213 |

7 |

|

Over 287 214 |

7,5 |

Note. This table is relevant for the purchase of the first object. For the second and subsequent ones the rate starts from 1%.

Stamp Duty (Imposto do Selo)

It is necessary to pay a fixed amount when making a transaction. It is 0.8% of the transaction value. That is, the calculation is based on the amount specified in the contract.

Annual Property Fee

IMI is calculated based on the cadastral value of the object. IMI rates vary depending on the type and location of the property:

- urban areas - from 0.3% to 0.45%;

- rural areas - 0.8%.

Rates of annual immovable property taxes (IMI) in Madeira in 2024 depends on the price of the object.

Tax Incentives And Preferences in Madeira

Buying a property in Madeira entitles the investor to certain preferences. All benefits are of a declarative nature, so in order to obtain them you must submit an application with a full set of documents to the relevant state authority. Benefits are not granted automatically.

Property Tax Exemption (IMI) For Primary Residences

The exemption is available for new construction or properties that will become the buyer's primary residence. This exemption reduces the initial costs for new owners, eases the financial burden and speeds up the process of settling in.

Social And Economic Benefits

Retirees, families with many children, and people with disabilities can expect a reduction in IMI. These discounts are aimed at helping low-income categories of citizens to purchase a home. The benefits are designed to maintain social equality and fairness and to improve the standard of living of these groups.

Benefits For Renovation of Historic Buildings

Owners investing in the renovation of historic buildings benefit from special tax advantages. These measures contribute to the preservation of Madeira's cultural heritage and encourage private investment in historically important properties. The benefits can take the form of substantial tax reductions or complete exemption for a certain period of time, making restoration projects more favourable from an economic point of view for investors.

NHR Regime

The NHR regime offers significant tax advantages for those who have recently become tax resident in Portugal and have not had this status for the last five years. To activate this tax regime, an application must be submitted within the first six months of residence.

Property owners may be exempted from paying tax on income earned abroad if certain conditions are met. This favours more favourable management of overseas assets.

If you receive rental income from property associated with a high-profit business, a favourable tax rate of 20% applies. This is significantly lower than standard tax rates, making investment in the Madeira property market even more attractive.

Leave a request on our website to receive a personalised property selection tailored to your finances and needs. Our manager will contact you as soon as possible.